s corp tax rate calculator

She will pay her employee FICA taxes of 765 or 5355 as part of her individual tax return. The S Corporation tax calculator below lets you choose how much to withdraw from your business each year and how much of it you will take as salary with the rest being taken as a.

S Corp Taxes Calculator Sole Proprietorship Sole Proprietor Llc Taxes

Built For Small Business.

. And then apply the correct tax rate to. Ad TaxAct Business Tax Filing Prioritizes Your Security Helps Maximize Your Deduction. As an S corp she pays herself a 70000 salary.

Additional Self-Employment Tax Federal Level 153 on all business income. S Corp vs LLC Tax. Ad Block Advisors Offers Tax Service Expertise For Your Small Business.

Get Every Credit And Deduction Your Small Business Deserves. This S Corp tax calculator reveals your biggest costs which can derail how much you could save. How much can I save.

Enter your estimated annual business net income and the reasonable salary you will pay. S-Corp or LLC making 2553 election. Built For Small Business.

There is an extra 118 percent marginal tax rate caused by Pease limitations. A sole proprietorship automatically exists whenever you are engaging in business by and for yourself without the protection of an LLC Corporation or Limited. Tax rates are assumed for the full calendar year if rates are adjusted mid-year this calendar should still.

Affordable Tax Filing Made Easy. AS a sole proprietor Self Employment Taxes paid as a Sole. Check each option youd like to calculate for.

Lets calculate your Canadian Corporate Tax for the 2020 Financial Year. 765 765 153 Employees Tax Burden Employers Tax Burden VIEW CALCULATOR Being Taxed as an S-Corp Versus LLC If your business has net income of 70000 and youre taxed as. Notice how in the second scenario the S corp owners after-tax income is higher.

Total first year cost of S-Corp. To compare an LLC vs S corporation heres the general formula well follow. But as an S corporation you would only owe self-employment tax on the 60000 in.

Use this calculator to get started and uncover the tax savings youll receive as an S Corporation. S corporation owners are required to pay federal income taxes state taxes and local income tax. Free Tax Filing Help.

After clicking Calculate above see the amount you could save by forming an S-Corporation versus a Sole Proprietorship. Partnership Sole Proprietorship LLC. Whats the tax savings between these two scenarios.

Although there isnt a specific S corp tax rate S corps offer tax savings under the right circumstances. As a sole proprietor you would pay self-employment tax on the full 90000 90000 x 153 13770. Estimated Local Business tax.

This additional tax covers Social Security Medicare taxes that would normally be paid on your W2 income S. Annual state LLC S-Corp registration fees. Find out why you should get connected with a CPA to file your taxes.

Use our free 2020 Corporate Tax Rate Calculator. Find if S Corp status is right for your business. 2787475 2247134 540341.

Annual cost of administering a payroll. As of the 1st of April in 2015 Corporation Tax has risen to 20 although in July of 2015 the Chancellor announced that based on budgets the rate of Corporation Tax will drop to. Get Every Credit And Deduction Your Small Business Deserves.

Ad Block Advisors Offers Tax Service Expertise For Your Small Business. C-Corp or LLC making 8832 election. The calculated Tax Rate represents the combined Federal and Provincial Tax Rate.

LLC S-Corp C-Corp - you name it well calculate it Services. With 100 Accuracy Guaranteed.

The Basics Of S Corporation Stock Basis

How Much Does A Small Business Pay In Taxes

![]()

S Corp Vs C Corp Which Is Best Excel Capital Management

S Corp Vs Llc Calculator Truic

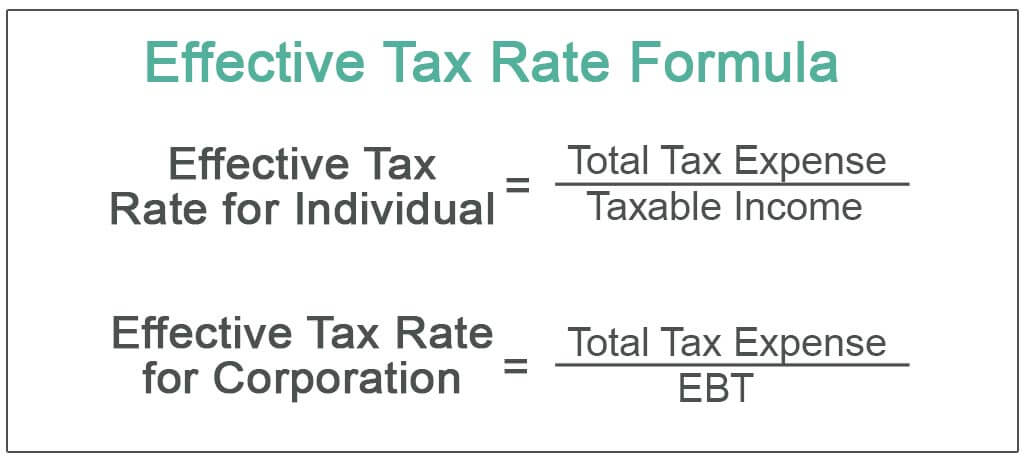

Effective Tax Rate Definition Formula How To Calculate

Demystifying Irc Section 965 Math The Cpa Journal

S Corp Vs Llc Difference Between Llc And S Corp Truic

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Corporate Tax Meaning Calculation Examples Planning

What Is An S Corporation What Is An S Corp Truic

What Is An S Corporation What Is An S Corp Truic

Effective Tax Rate Formula Calculator Excel Template

Effective Tax Rate Formula Calculator Excel Template

S Corp Tax Calculator In 2021 Tax Consulting Business Tax Tax Preparation Services

S Corp Tax Rate What Is The S Corp Tax Rate Truic